One of the subjects where there is a keen interest to closely consider the impact of the UK’s decision to leave Europe is Law. Not just to understand what it will do to demand for the UK, but also what wider implications, both positive or negative, it may have for other countries.

This blog compares demand from the EU, compared to global demand for the study of Law in the period of June 2015 – January 2016 vs June 2016 – January 2017, and we are seeing some striking results partly for the UK, but more so for the Republic of Ireland.

While many people might jokingly suggest that having fewer law students in the UK might not be such a bad thing, in all seriousness there are implications for UK universities and law schools in particular which will need to be understood.

EU student demand for Law

Since the UK voted to leave the European Union, demand across the Hotcourses Group websites (which accounts for over 66 million annual searches across all subjects to all markets from prospective international students), has shifted away from studying Law in the UK (from 41.2% to 36.2%) to users based in other EU countries.

These statistics would appear to be directly echoed by the UCAS 2017 mid-cycle statistics which were published on 1st February 2017 and show that the number of Law applications from the EU has reduced from 9,050 (in 2016) to 8,590 (in 2017), which represents a 5% drop.

So like UCAS, we have also seen a corresponding 5% drop in the research of prospective EU students looking to undertake a Law course.

However, our data provides an interesting revelation that the biggest beneficiary of the drop in demand for the UK appears, perhaps logically, to be the Republic of Ireland (rising from 5.3% to 25.4%). This is a quite startling increase when comparing the same time intervals in 2015/16 with 2016/17. A hugely positive signal for Law Schools in the Republic of Ireland.

July 2015 – January 2016 July 2016 – January 2017

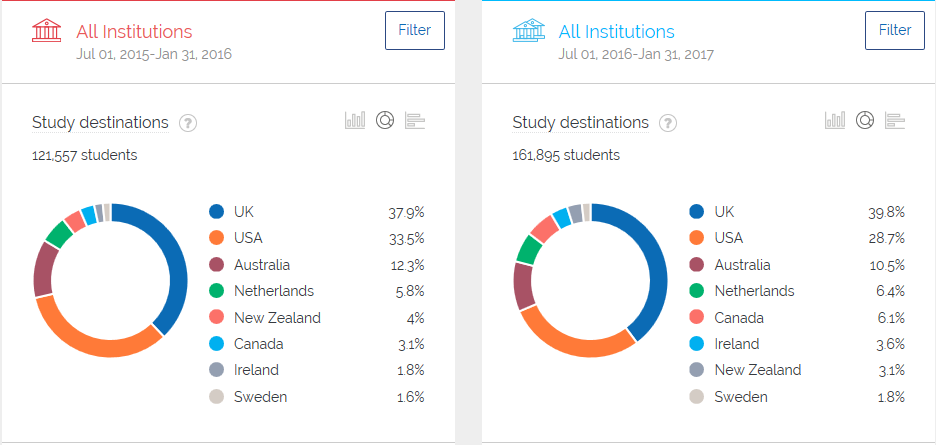

Global demand

While EU student demand for Law to the UK has shrunk by 5%, global demand has actually increased (37.9% to 39.8%). So whilst the picture may remain tough for UK law schools in terms of EU recruitment, there are at least signs that non-EU recruitment could prove to be more fruitful. For instance we have seen the UK rise from 41.8% to 46.4% of searches from Thai students looking to study Law, there has even been a modest rise in demand from India (from 28.6% to 28.9%) a market which has been notoriously difficult for years. As challenging as the Trump effect may prove for the US, it offers a ray of light to the UK.

The Republic of Ireland has also seen growth globally too, but more modest (from 1.8% to 3.6%) in terms of their share of the international (non-EU) market.

July 2015 – January 2016 July 2016 – January 2017

Conclusion

For UK university law schools there is likely to be some re-balancing away from EU markets towards more domestic and non-EU international recruitment. International markets offer a genuine opportunity for growth, not least because of the early implications that President Trump appears to be having on the attractiveness of the United States.

For the Republic of Ireland there is a huge opportunity to substantially grow their share of EU students wishing to study Law. As the UK prepares to exit the European Union, Republic of Ireland Law Schools should be preparing to throw their doors open to EU students.

This data was taken from the Hotcourses International Insights Tool which tracks over 66 million prospective international students researching higher education courses every year. For more information or access to the tool, please contact insights@hotgroupdev.wpengine.com

You might like...

Post-Study Work as a Driver in Destination Choice across Australia, Canada, the UK, and the US

How graduate visa policies and employment prospects affect student perception and choice.

Barriers, Concessions and Support: An overview of international study policies in 4 key destination countries

The latest government policies relating to international students in the UK, Australia, US and Canada

Prospective student trends 1 year on from Brexit

This blog by Aaron Porter, Director of Insights, was originally written for Research Fortnight.