One of the most common questions across higher education throughout the past year has been: how can we further diversify our international student population?

For highly ranked institutions globally, there is a common need to reduce reliance on China. In May, it was reported in the UK that the Office for Students (OfS) wrote to 23 institutions over ‘high levels’ of Chinese students, encouraging them to have ‘contingency plans’ in case of a ‘sudden drop’ in numbers.

Comparably, many mid-to-low ranked institutions around the globe have become overly reliant on the Indian market, particularly for postgraduate recruitment. This is evidenced by more than 170,000 Canadian study permits being issued to India in 2021 (IRCC), more than three times the volume of the second biggest source market, China. In the UK, for institutions outside the top 200 of the THE World Ranking, India accounted for more than 40% of PGT enrolments in the 2021/22 academic cycle (HESA).

The importance of these two markets is clear. But the question emerges: which other markets outside of China and India should we be paying attention to?

Our IQ team of data scientists and higher education research professionals has been exploring which international source markets to keep an eye in 2024, with a focus on emerging markets in Africa.

Source market population and economic growth

The IQ team at IDP produces five-year forecasts for institutions’ international recruitment based on historical enrollment trends, in addition to key market variables that highly correlate with market recruitment volume. When looking at undergraduate recruitment, two of the variables that we see having the highest correlation with historical recruitment volume from a given market are population growth and GDP.

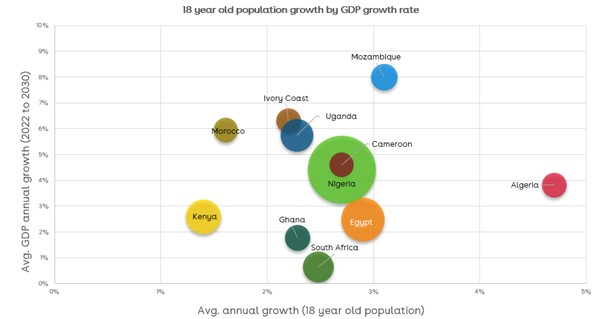

In the below chart, we’ve looked at the key African source markets with high 18-year-old population growth and growing GDP. The average annual growth rate of the 18-year-old population between 2022 and 2030 is plotted on the X-axis and the forecasted average annual growth rate of GDP on the Y axis. The size of the bubbles reflects the size of the source market population, based on 2022 UN data.

Within the top 30 source markets for recruitment into the UK, Australia, and Canada, the country with the highest 18-year-old population growth between now and 2030 is Algeria - and that is globally, not just within Africa – and this demographic is set to grow by an average of 4.7% year-on-year. In addition, Algeria’s GDP annual growth rate, forecast by the International Monetary Fund, is also predicted to grow by 3.8% annually on average up to 2028 (which is as far as the IMF projects).

The gross enrolment rate in tertiary education in Algeria is also growing, having been reported at 54% in 2021, up from 37% in 2015. Algeria is already the third largest African source market for Canada, after Nigeria and Morocco. While current volumes to North America are low, with only 300 enrollments in US during the 2022/23 school year, and 7,510 enrollments in Canada in 2022, the population and GDP indicators point to Algeria being an emerging market over the next 5-10 years.

Nigeria, a more established source market for many institutions, is growing in importance and is set to see increasing volumes of 18-year-olds over the remainder of this decade. However, devaluation of the Naira and climbing annual inflation, which rose to 25.8% in August 2023, have created challenges with application-to-enrollment conversion from this market as students become increasingly price sensitive.

Egypt is also a market with growing recruitment potential based on the increasing student population. Almost 20% of Egyptians are aged 15-24 and their population of 18-year-olds is set to grow by an average annual growth rate of 3% year-on-year from 2023 to 2030. However, similar to Nigeria, they face challenges with inflation, and Egypt's annual urban consumer price inflation rose to a historic high of 38% in September 2023.

While Mozambique is set to see significant population and GDP growth, this is not historically a strong market for recruitment, with only 147 students enrolled in the US during the 2022-23 school year.

Overcoming barriers for recruitment growth

The key theme across all these markets is price sensitivity. Higher education institutions will need to consider how they can overcome price barriers on course fees, accommodation and living costs in order to capitalize on the growing student populations in these source markets.

IDP IQ can overlay this data with institution market share and historical enrolment trends to produce international enrolment forecasts. Contact us for more information about how IDP Connect can support your institution with international recruitment forecasting and strategic planning.

You might like...

Changing Parental Perceptions and Motivations in the International Education Decision Making Process

Parents are now more concerned about graduate employment opportunities than distance from friends and family.

Growing Student Markets in Africa to Watch in the Next Decade

Source market population and economic growth are key factors

How High Cost of Living and Global Economic Instabilities are Affecting International Student Perceptions

Supporting and encouraging prospective students to do financial research and their sums.